Communications Officer

Institute of Certified Public Accountants of Uganda

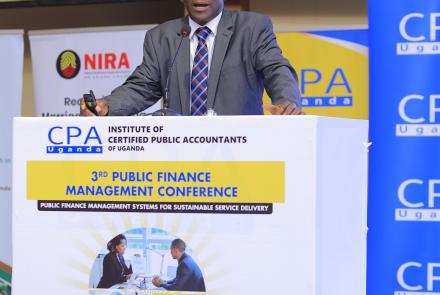

CPA Aziz Kalule Ssettaala, Assistant Commissioner of Accounts at the Ministry of Finance, Planning, and Economic Development has explained that effective Public Finance Management (PFM) reform is driven by the recognition that high-quality financial reporting is fundamental to strengthening public financial management, informed policymaking, and effective oversight.

He emphasised the urgency for alignment of Public Finance Management (PFM) reforms with the International Public Sector Accounting Standards (IPSAS) to capture an accurate picture of the Uganda’s financial performance.

Digital platforms have transformed how government entities plan, budget, and report, creating a robust, timely, and transparent financial reporting environment.

From the enactment of the Public Finance and Accountability Act (PFAA) in 2003, which established the Accountant General’s Office and the Public Finance Management Act, 2015, to the rollout of key systems such as the Integrated Financial Management System (IFMS), Programme Budgeting System (PBS), and electronic Government Procurement (e-GP), PFM reforms have been effective in enhancing Uganda’s service delivery.

According to CPA Ssettaala, central to the reforms is the adoption of a revised Government Chart of Accounts aligned with international standards, specifically the Government Finance Statistics 2014 and accrual-based International Public Sector Accounting Standards (IPSAS).

He was delivering a presentation on developments in public finance reporting at the 3rd Public Finance Management (PFM) conference at the Imperial Resort Beach in Entebbe on 24 April 2025.

A significant part of Ssettaala’s presentation focused on Uganda’s gradual transition from a modified cash basis to full accrual accounting, a process slated to span from FY 2023/2024 to FY 2031/2032. He emphasised that this transition is not merely an accounting shift, but a fundamental transformation in how government measures its financial obligations, assets, and the true cost of delivering services.

However, he acknowledged several challenges in this transition. These include the valuation and recognition of historical assets, the limitations of current PFM systems in supporting accrual accounting, gaps in technical capacity, and the need for greater stakeholder buy-in.

According to CPA Ssettaala, the Ministry has launched multiple initiatives to address these issues, including training accounting staff and enhancing IFMS capabilities, involving auditors early in the transition roadmap and continuously engaging Parliament and other oversight institutions.

CPA Ssettaala outlined the next steps, which include completing the validation of historical asset data in IFMS, finalising the transition roadmap, and incorporating sustainability reporting into Uganda’s financial disclosures. He emphasised the importance of data analytics and real-time dashboards in future financial reporting.

The conference is being held from 23 – 25 April 2025 at the Imperial Resort Beach, Hotel, Entebbe, and online, under the theme, Public Finance Management Systems for Sustainable Service Delivery.

END