By Jackline Nabirye

Communications Officer

Institute of Certified Public Accountants of Uganda

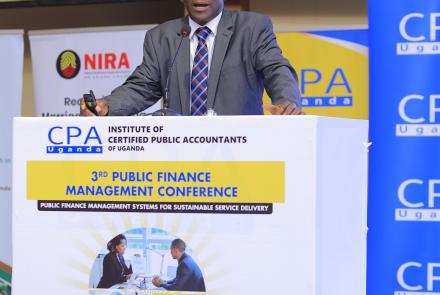

CPA Samson Sowate, the Commissioner for Risk & Advisory at the Ministry of Finance, Planning and Economic Development has urged accountants to rise beyond traditional financial roles and become architects of sound governance and risk management systems.,

He underscored the evolving role of accountants as stewards of integrity in the public sector, emphasising their potential to drive reforms that promote transparency, efficiency, and accountability.

“Accountants must go beyond traditional roles and become architects of sound governance and risk management frameworks,” he said.

CPA Sowate was delivering a presentation on the accountant’s role in public governance, risk management and oversight at the 3rd Public Finance Management (PFM) conference.

He urged institutions to invest in equipping professionals with skills in forensic audit, enterprise risk management, and financial oversight.

He further noted that fostering ethical practices, enhancing internal controls, and proactively managing risks are essential steps to rebuilding public trust and delivering value for money in government programmes.

“Good governance is not just a political obligation. It is a professional responsibility. Accountants must be empowered to identify systemic weaknesses, advise on corrective strategies, and ensure transparency in public resource management,” said CPA Sowate. Reinforcing this message, CPA Jeremiah Kato, Head of Enterprise Risk Management at the Uganda National Oil Company Limited (UNOC) called on accountants to take centre stage in public sector risk management.

“Accountants are not just custodians of numbers. They are architects of transparency, compliance, and sound public administration,” said CPA Kato. Drawing on his experience in Uganda’s oil and gas sector, he advocated for Enterprise Risk Management (ERM) to be fully embedded within public institutions.

“Risk management is not a one-off exercise. It must be built into the DNA of every public institution,” he emphasised, highlighting tools such as risk registers and early-warning mechanisms as essential for proactive oversight.

CPA Kato also pointed out challenges to effective Enterprise Risk Management (ERM), including resistance to change, skill gaps, and lack of leadership buy-in. He called for continuous training, ethical leadership, and inter-departmental collaboration to cultivate risk-conscious institutional cultures.

Organised by the Institute of Certified Public Accountants of Uganda (ICPAU), the PFM conference has brought together a wide range of public sector actors; accounting officers, auditors, economists, planners, policymakers, development partners, parliamentarians, and civil society representatives. The hybrid event, taking place at the Imperial Resort Beach Hotel, Entebbe, and online, runs from 23 to 25 April.

Supported by partners such as the National Identification & Registration Authority (NIRA), National Agricultural Research Organisation (NARO), PostBank Uganda, Electricity Regulatory Authority (ERA), and MTN Uganda, the conference reflects a united effort to transform Uganda’s public finance systems for more effective, sustainable service delivery.

END